Written to help you do a better job of managing your personal and family financial affairs and to help you get more for your money. You get ideas on saving, investing, cutting taxes, making major purchases, advancing your career, buying a home, paying for education, health care and travel, plus much, much more. Special issues cover the latest information about car buying (December) and Mutual Funds (March and September).

Take a Lump Sum?

Live Long and Prosper

Kiplinger’s Personal Finance

STATE TAXES: THE VOTERS WEIGH IN • Midterm ballot measures included hiking taxes on the wealthy, legalizing cannabis and more.

JOB HUNTERS HAVE A NEW NEGOTIATING TOOL • More employers will be required to disclose salary ranges in job postings.

DON’T RUSH TO BUY A SALE ITEM • A survey of major retailers found that discounted prices are often misleading or even fake.

CALENDAR 2/2023

BRIEFING • INFORMATION ABOUT THE MARKETS AND YOUR MONEY.

MILLION-DOLLAR MORTGAGE LIMITS

VEHICLES THAT GO THE EXTRA MILE

YOU’LL SOON PAY FEWER PESKY FEES

THE RIGHT ROBO ADVISER FOR YOU • We guide you through a crowded field to find the best fit.

Fit the Robo to Your Needs

Utility Stocks Are Losing Power

Follow the Money With These Funds • Firms with healthy cash flows are great choices in dicey markets.

This Tech Fund Goes Its Own Way • Steering clear of some popular stocks has paid off for this portfolio.

Stick With Dividend-Paying Stocks

YOU CAN DEPEND ON DIVIDENDS • Yields on these stocks are attractive, and the shares can add ballast to your portfolio.

Fixing Your Fixed-Income Portfolio • After a brutal year for bonds, prices are attractive and yields are high.

New Life for the 60/40 Portfolio

Checking in With Two Value Funds

KEY DATA FOR OUR MUTUAL FUND PICKS • Kiplinger 25 funds are no-load; you can buy them without sales charges. For more about the funds, visit kiplinger.com/links/kip25

Earn substantial inflation-beating yields safely and reliably, under any market conditions.

RESHOPPINGAUTO INSURANCE IN A HIGH-INFLATION WORLD • Premiums are on the rise, but it’s a good time to find deals on policies.

ARE SERIES EE BONDS WORTH A LOOK?

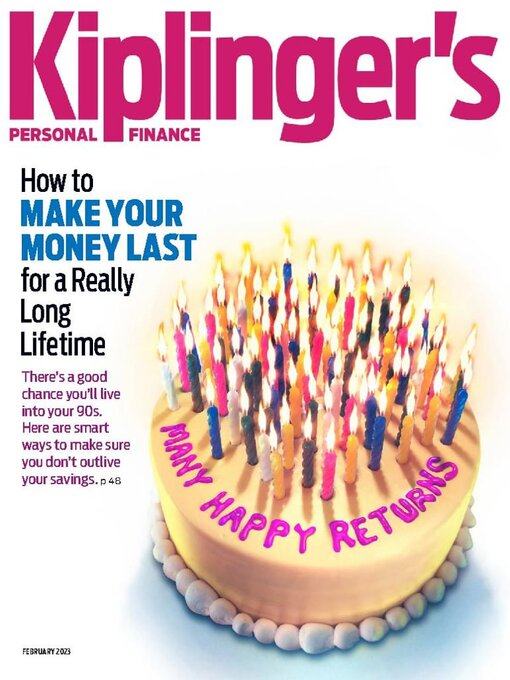

HOW TO PREPARE FOR A REALLY LONG RETIREMENT • Longevity is the biggest financial risk for retirees. Take these steps well before you retire to grow and preserve your savings.

How to Make the Most of a Longer Life

Don’t Be the Victim of Cyber Fraud

RETIRE WHEN YOU WANT • Whether you’re almost there or still have years to go, we’ll show you how to retire on your terms, on your schedule.

Breeze Through a Fund Prospectus • Use our guide to focus on what’s important to make this task less daunting.

Is an Adjustable-Rate Mortgage Right for You? • With fixed rates rising, ARMs offer lower monthly payments for the initial term. But know the risks.

A Vintage Budgeting Method Is Back

HEALTH CARE BARGAINS ABROAD • If you can’t afford a medical procedure here, investigate options overseas.

Planting the Seeds of a New Life • This sustainable farm helps women adapt to a world outside of prison.

Jan 01 2025

Jan 01 2025

Dec 01 2024

Dec 01 2024

Nov 01 2024

Nov 01 2024

Oct 01 2024

Oct 01 2024

Sep 01 2024

Sep 01 2024

Aug 01 2024

Aug 01 2024

July 2024 Double Issue

July 2024 Double Issue

Jun 01 2024

Jun 01 2024

May 01 2024

May 01 2024

Apr 01 2024

Apr 01 2024

Mar 01 2024

Mar 01 2024

Feb 01 2024

Feb 01 2024

Jan 01 2024

Jan 01 2024

Dec 01 2023

Dec 01 2023

Nov 01 2023

Nov 01 2023

Oct 01 2023

Oct 01 2023

Sep 01 2023

Sep 01 2023

Aug 01 2023

Aug 01 2023

Jul 01 2023

Jul 01 2023

Jun 01 2023

Jun 01 2023

May 01 2023

May 01 2023

Apr 01 2023

Apr 01 2023

Mar 01 2023

Mar 01 2023

Feb 01 2023

Feb 01 2023